Y4Trade Deep Dive: From Simulation to Live Trading: Reimagining the Trader’s Growth Journey

Have you ever wondered if you could sharpen your trading skills without risking a cent and still gain access to a funded live account? For most traders, this notion has been little more than a dream. Enter , a platform designed to turn that fantasy into reality by providing a structured pathway from demo trading to live-account funding.

Built for those who want to mitigate early-stage risks while gaining real-world experience, Y4Trade deploys a clear simulation challenge framework that lowers entry barriers and unlocks ample growth potential.

Platform Overview: What is Y4Trade?

Launched on July 4, 2025, Y4Trade is available via both web and mobile web app—no downloads required. It features a proprietary trading system seamlessly integrated with TradingView charts, delivering a clean interface and smooth user experience for novices and veteran traders alike.

Since its debut, Y4Trade has earned a strong reputation for system stability, hassle-free withdrawals, and transparent challenge mechanics.

The platform focuses on forex, CFDs, and select cryptocurrencies, following a “demo-first, live-second” challenge structure. Traders must complete two demo-stage benchmarks—each with defined profit and risk criteria—to qualify for an actual funded account.

Y4Trade Trading Challenge Platform

Y4Trade Trading Challenge: Core Features

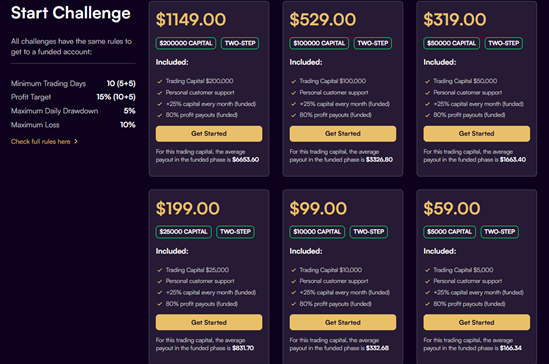

- Flexible Account Tiers

Starting from $5,000 up to $200,000, users can select a challenge tier that aligns with their experience and risk tolerance.

Challenge Accounts of Each Category

- No Time Pressure—Focus on Consistency

There’s no time limit on challenges, allowing traders to progress at their own pace and focus on strategy over speed.

- Generous Profit Split

Traders keep up to 80% of the profits from live accounts. Some upgrade packages can boost the split to 90%.

- Clear Growth Path

Consistently profitable accounts can request capital increases monthly, with growth capped at $1,000,000, supporting long-term development.

- Custom Terminal with TradingView Integration

The in-house platform combines ease of use with powerful technical analysis tools, supporting backtesting and diverse trading strategies.

- Wide Range of Tradable Assets

Access major forex pairs (e.g., EUR/USD, USD/JPY), global indices, commodities, and selected cryptocurrencies, covering the world’s leading markets.

- Global Withdrawal Network

Enjoy 200+ fiat withdrawal options, including local bank transfers, wire transfers, and e-wallets. Fast and reliable payouts worldwide.

- Built-in Trader Education

The Trader Academy offers in-depth courses covering strategy, psychology, and risk management—ideal for developing trading discipline.

FAQ:New to Y4Trade?

- Can I use an EA or automated trading?

Y4Trade supports robotic and automated strategies throughout the challenge and live phases. - Do I need to download any software?

No downloads are needed. Y4Trade runs entirely through a web interface compatible with mobile web apps. - How does profit sharing work?

Funds are split 80/20 by default (trader/platform), with the option to upgrade to 90/10. - What are the profit targets?

- Stage 1: 10% gain

- Stage 2: 5% gain (with tighter risk discipline required)

- What if I fail a challenge?

No worries—you’re eligible for a retake. Y4Trade even offers discounted reenrollment and personalized coaching.

How Y4Trade Stands Out from Opponents

| Feature | Y4Trade | Other Platforms |

| Platform | Proprietary + TradingView, web/mobile friendly | MT4/MT5 based—requires downloads |

| Instruments | Forex, indices, commodities, crypto | Mostly forex, limited CFDs |

| Commissions | No commissions or hidden spreads | Often includes commissions or inflated spreads |

| Time Limit | None—trade at your own pace | Typically 30–60 day deadlines |

| Profit Split | Up to 80%, upgradeable to 90% | Normally between 50–80% |

| Challenge Tiers | Starts at $5,000 – multiple tiers | Often starts at $10,000+ |

| Account Growth | Monthly scalable up to $1M | Rarely scalable without requalification |

| Risk Control Rules | Pre-set daily/monthly loss caps | Often unclear or excessively rigid |

| Withdrawals | 200+ fiat currencies, local bank & e-pay | Usually bank wire or credit card only |

| Education & Support | Comprehensive Trader Academy included | Often limited or paid separately |

| Target User | Newbies to intermediate traders; ideal for steady growth | Favors experienced traders; less beginner-friendly |

Compared to most mainstream platforms, Y4Trade stands out with its flexibility and trader-friendly approach: a no-time-limit challenge mode, up to 90% profit share, entry-level accounts starting at just $5,000, and a well-structured progression system supported by educational resources. These features make it a viable long-term tool for traders at various stages of experience.

In contrast, most competitor platforms rely heavily on rigid MT4/MT5-based setups, offer higher entry thresholds, and lack clear room for growth—making them less beginner-friendly.

From a holistic perspective, BrokerHive Y4Trade is a platform that emphasizes trader development and risk control, offering a practical alternative for those seeking a real-market challenge experience.

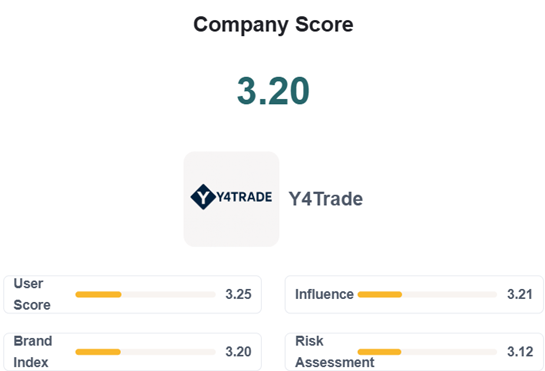

BrokerHive Rating: A Young Platform with Promising Potential

According to the BrokerHive brokerage rating system, Y4Trade currently scores 3.20 out of 10, placing it in the mid-range among emerging platforms. While the brand is still building recognition and market presence, its challenge logic is coherent, and the platform design suggests long-term potential for user development.

Score of Y4Trade in BrokerHive

In today’s volatile market landscape, Y4Trade’s low entry barriers and risk-mitigated design present a rare opportunity for beginners to gain live trading experience under controlled conditions.

That said, it’s important to note: once traders enter the live phase, all market risk is borne by the user. Although the platform has set protective thresholds, the leveraged nature of forex and CFD trading still demands cautious, disciplined participation.

From perspective, Y4Trade helps mitigate entry risks through a structured simulation phase, allowing users to gradually adapt to market rhythm. However, once live trading begins, market volatility becomes real and often unforgiving.

Given the inherently high leverage and rapid price swings of forex and CFD instruments, traders should assess their risk tolerance clearly and avoid treating challenge accounts as shortcuts to quick profits. Instead, we recommend a mindset of long-term learning and capital discipline.

Whether you’re just starting or already experienced, choosing the right broker can make all the difference. At BrokerHive, we aggregate comprehensive data on global trading platforms—from user feedback and platform features to regulatory backgrounds—helping you make confident, informed choices.

Follow us for in-depth reviews, market insights, and timely platform updates—because your trading deserves nothing less than clarity and trust.

Source: Y4Trade Deep Dive: From Simulation to Live Trading: Reimagining the Trader’s Growth Journey